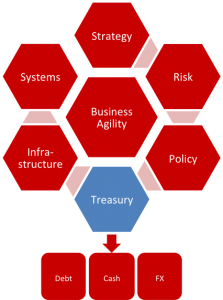

Management of treasury operations is a core finance function that a CFO has prime accountability. For large capital intensive businesses, management of debt portfolio, raising debt funding, managing interest rate risk and refinance risk form a very large part of the treasury operations.

Management of treasury operations is a core finance function that a CFO has prime accountability. For large capital intensive businesses, management of debt portfolio, raising debt funding, managing interest rate risk and refinance risk form a very large part of the treasury operations.

Managing liquidity and optimising cash position, investments and strategies for managing the risk arising out of FX and commodity exposures can make a difference in financial outcomes of the business. The broad range of services include:

Debt management

Management of debt portfolio and interest rate risk

Refinance risk

Domestic and/or offshore capital raising

Portfolio mix

Debt policy and governance framework

Manage credit rating/ debt covenants

Hedging strategy

Performance benchmark

Reporting

FX and Commodity

FX and Commodity

Management of FX and commodity risk

Hedging strategy

Performance benchmark

Reporting

Cash and Liquidity management

Liquidity management strategy

Cash flow – budgeting and forecasting

Integration with financial and corporate systems

Capital allocation – capital expenditure intensive businesses

Monitoring cash flows- short term and longer term

Performance

Reporting

Investments

Investments

Investment strategy

Approved Instruments/ counterparties

Liquid v static investments

Policy framework/ Governance framework

Performance benchmark

Reporting